Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

- How To Determine the Age Of Your Roof For Insurance? (Explained)

- How Often Will Insurance Pay For A New Roof? (Explained)

- How To Decline Insurance Offers? (Explained)

- How Do Dealerships Verify Insurance? (Explained)

- How To Prove To Insurance Damage Is From Lightning?

- How Much Is GAP Insurance for Toyota? (Explained)

Author: Sayan Dutta

Hi, my name is Sayan Dutta and I’m the creator of the ReadUs24x7. I am an Electronics and Telecommunication Engineering by qualification & digital marketer by profession. I am a passionate digital marketer, blogger, and engineer. I have knowledge & experience in search engine optimization, digital analytics, google algorithms, and many other things. I have knowledge in WordPress Website Development as well as image designing.

Life insurance is a way of protecting your loved ones financially in case of your death. However, not everyone can get the same rates and coverage options when applying for life insurance. Some people may have to pay more or accept fewer benefits due to their higher risk factors. One of the ways that life insurance companies charge more for high-risk applicants is by adding a flat extra premium to their policy. In this article, we will explain what a flat extra premium is, how it works, what factors may lead to it, and how you can approach it. Understanding…

Traveling is one of the most rewarding and exciting experiences in life, but it also comes with some risks and uncertainties. That’s why you need a reliable and comprehensive travel insurance plan that can protect you from unexpected events and emergencies. Avanti Travel Insurance is an award-winning specialist travel insurer that offers a range of cover options for different types of travelers and destinations. Whether you’re planning a single trip, a cruise, or a long stay abroad, Avanti Travel Insurance can help you find the right plan for your needs and budget. In this article, we’ll give you an overview…

Health insurance is a type of coverage that pays for medical expenses incurred by you or your dependents in case of illness, injury, or preventive care. Having health insurance can protect you from unexpected and high medical bills, as well as provide access to quality health care services. In this article, we will explain how to buy health insurance in New Jersey, what the eligibility requirements, enrollment periods, available plans and costs, and what to consider before buying health insurance. Understanding Health Insurance Coverage in New Jersey New Jersey has its own online health insurance marketplace called GetCoveredNJ, where you…

Health insurance is a type of coverage that pays for medical expenses incurred by the insured. Health insurance can help protect you from high medical costs and provide access to quality healthcare services. In this article, we will explain how to buy health insurance in Colorado, what are the different types of health plans available, and what are the benefits of having health insurance. Affordable Health Care in Colorado Colorado is one of the states that has implemented the federal Affordable Care Act (ACA), which aims to make health insurance more accessible and affordable for Americans. The ACA has expanded…

If you are a CPA who has enrolled in one of the AICPA-endorsed life insurance plans, you may be eligible to receive a refund on your premiums every year. This is one of the unique benefits of the AICPA life insurance program, which offers affordable and flexible coverage options for CPAs and their families. In this article, we will explain everything you need to know about the AICPA life insurance refund, including what it is, how it works, how to receive it, and how to save more on your life insurance. What is the AICPA Life Insurance Refund? The AICPA…

Police officers have one of the most dangerous and stressful jobs in the world. They face life-threatening situations every day and put their lives on the line to protect and serve their communities. That’s why life insurance is essential for police officers and their families. Life insurance can provide financial security and peace of mind for the loved ones of police officers in case of an unexpected death. It can help cover funeral costs, pay off debts, replace lost income, fund education, and more. However, not all life insurance policies are created equal. Police officers need to find a policy…

Tenant insurance is an important type of insurance for renters in Winnipeg. It protects your belongings from damage or loss due to events such as fire, theft, and vandalism. It also provides liability coverage in case you accidentally cause damage to someone else’s property or injure someone. Understanding Tenant Insurance in Winnipeg Tenant insurance policies typically cover the following: Personal property: This includes your furniture, appliances, electronics, clothing, and other belongings. Additional living expenses: This coverage pays for the extra costs of living, such as hotel and restaurant bills, if you are unable to live in your rental unit due…

Water damage is one of the most common types of home insurance claims, and kitchen cabinets are a particularly vulnerable area. If you experience water damage to your kitchen cabinets, it’s important to understand your insurance coverage and take steps to minimize the damage and file a claim. Understanding Coverage for Water Damage to Kitchen Cabinets Most homeowners insurance policies cover water damage to kitchen cabinets caused by sudden and accidental events, such as a burst pipe, a dishwasher leak, or a flood. However, coverage may vary depending on your specific policy, so it’s important to review your policy documents…

Tesla Insurance is available to Tesla vehicle owners in certain U.S. states, with intentions to expand. Tesla Insurance promises to provide affordable prices and comprehensive coverage utilizing car sensor data and Tesla’s technology, safety, and repair cost expertise. In this article, we will explain what Tesla Insurance is, how it works, what factors affect its cost, and what are its pros and cons. We will also review the customer experience and ratings of Tesla Insurance. Understanding Tesla Insurance Tesla Insurance is Tesla-specific automotive insurance. It provides full coverage and claim handling for Tesla owners in certain U.S. states, with more…

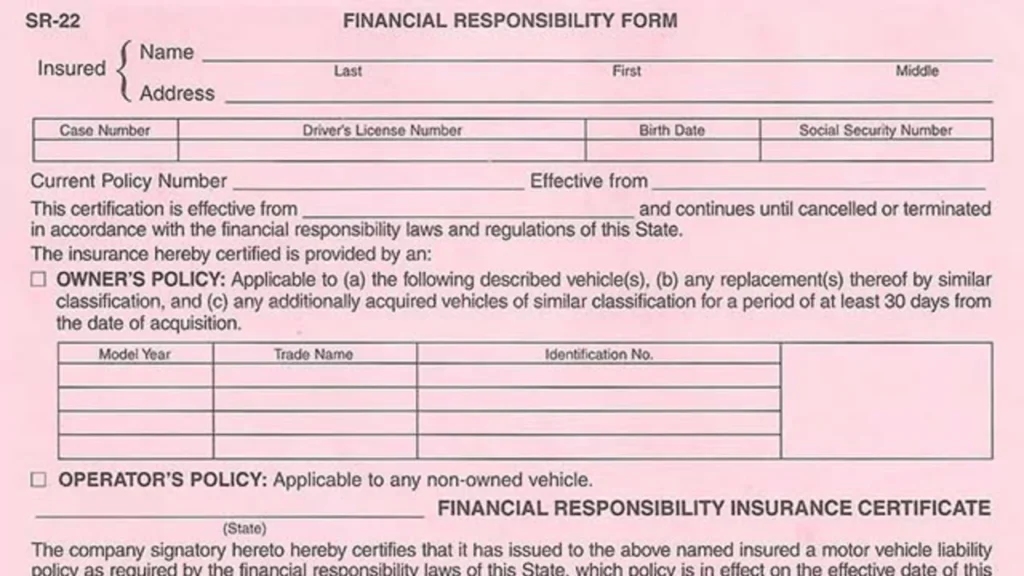

If you are a driver in Washington State who has been convicted of certain traffic violations, such as DUI, reckless driving, or driving without insurance, you may be required to file an SR22 form with the Department of Licensing (DOL) to prove that you have adequate liability insurance. The SR22 form is not an insurance policy itself, but a certificate that your insurance company issues to verify that you have met the state’s minimum coverage requirements. The cost of SR22 insurance in Washington State depends on several factors, such as your driving record, age, gender, location, coverage limits, and insurance…