If you are a driver in Washington State who has been convicted of certain traffic violations, such as DUI, reckless driving, or driving without insurance, you may be required to file an SR22 form with the Department of Licensing (DOL) to prove that you have adequate liability insurance.

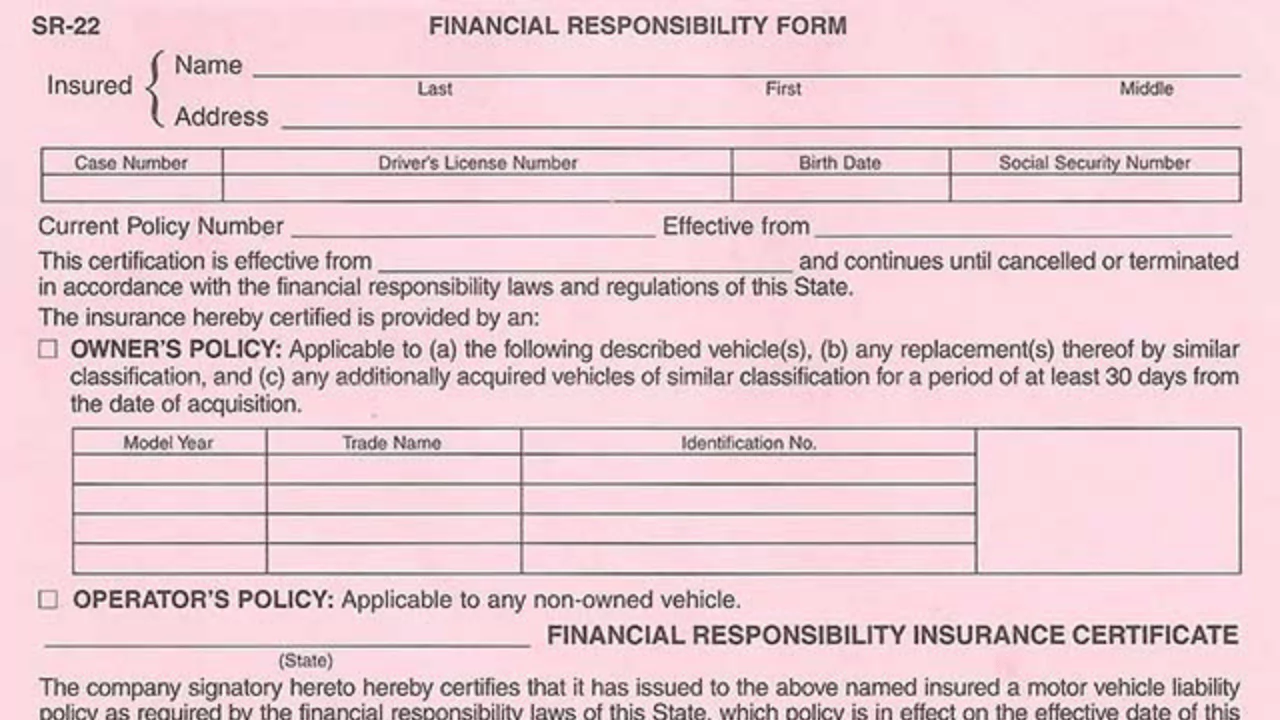

The SR22 form is not an insurance policy itself, but a certificate that your insurance company issues to verify that you have met the state’s minimum coverage requirements.

The cost of SR22 insurance in Washington State depends on several factors, such as your driving record, age, gender, location, coverage limits, and insurance provider.

What is SR22 Insurance?

SR22 insurance is a term that refers to the liability insurance that drivers who have been deemed high-risk by the state must carry. It is not a separate type of insurance, but rather an endorsement or add-on to your existing auto insurance policy.

The SR22 form is a document that your insurance company files with the DOL to certify that you have at least the minimum amount of liability coverage required by law. The minimum liability limits in Washington State are:

- $25,000 for bodily injury or death of one person per accident

- $50,000 for bodily injury or death of two or more people per accident

- $10,000 for property damage per accident

These limits are often expressed as 25/50/10. You may choose to purchase higher limits or additional coverage, such as collision, comprehensive, uninsured/underinsured motorist, or personal injury protection (PIP), depending on your needs and budget.

When is SR22 Insurance Required?

You may need to file an SR22 form with the DOL if you have:

- Been convicted of or forfeited bail for certain offenses, such as DUI, reckless driving, hit-and-run, or driving while suspended or revoked

- Failed to pay judgments resulting from traffic accidents

- Driven or owned a vehicle involved in an accident without having liability insurance or other proof of financial responsibility

- Had your license suspended or revoked for any reason

The DOL will notify you by mail if you are required to file an SR22 form. You must obtain an SR22 form from an approved insurance company and submit it to the DOL within 15 days of receiving the notice. If you fail to do so, your license will be suspended until you comply.

How long do you need SR22 Insurance?

In most cases, you need to maintain SR22 insurance for three years from the date you are eligible to reinstate your license. However, the exact duration may vary depending on the nature and severity of your offense. For example, if you are convicted of DUI, you may need to keep SR22 insurance for five years. You must keep your SR22 insurance active and pay your premiums on time during this period. If your policy lapses or is canceled for any reason, your insurance company will notify the DOL and your license will be suspended again until you reinstate your SR22 insurance.

Factors Affecting the Cost of SR22 Insurance in Washington State

The cost of SR22 insurance in Washington State is determined by several factors, including:

Driving Record

Your driving record is one of the most important factors that affect your SR22 insurance rates. If you have a history of traffic violations, accidents, or claims, you will be considered a high-risk driver and pay more for your insurance. Conversely, if you have a clean driving record or improve your driving habits over time, you may qualify for discounts or lower rates.

Age and Gender

Your age and gender also influence your SR22 insurance rates. Younger drivers, especially males under 25 years old, tend to pay more for their insurance because they are statistically more likely to be involved in accidents or make claims. Older drivers, especially females over 55 years old, tend to pay less for their insurance because they are statistically more likely to be safer and more experienced drivers.

Location

Your location also affects your SR22 insurance rates. Different areas in Washington State have different levels of traffic density, crime rates, weather conditions, and accident risks. These factors can impact the likelihood and severity of claims and affect the cost of repairs and medical expenses. Therefore, drivers who live in urban areas with higher population density and crime rates tend to pay more for their insurance than drivers who live in rural areas with lower population density and crime rates.

Coverage Limits

Your coverage limits also influence your SR22 insurance rates. The higher the limits you choose for your liability coverage, the more protection you have in case of an accident. However, higher limits also mean higher premiums because they increase the potential payout from your insurance company. Therefore, you should choose the coverage limits that suit your needs and budget. You may also consider purchasing additional coverage, such as collision, comprehensive, uninsured/underinsured motorist, or personal injury protection (PIP), to protect yourself from other risks and expenses. However, these optional coverages will also increase your SR22 insurance rates.

Insurance Provider

Your insurance provider also affects your SR22 insurance rates. Different insurance companies have different methods of calculating and applying rates, discounts, and fees. They also have different levels of customer service, claims handling, and financial stability. Therefore, you should shop around and compare quotes from multiple insurance companies to find the best SR22 insurance deal for you.

Average Cost of SR22 Insurance in Washington State

Cost breakdown

The cost of SR22 insurance in Washington State consists of two main components: the SR22 filing fee and the insurance premium.

- The SR22 filing fee is a one-time charge that your insurance company pays to the DOL to file the SR22 form on your behalf. The fee is usually between $15 and $25, depending on the insurance company. You may have to pay this fee upfront or as part of your first premium payment.

- The insurance premium is the amount you pay to your insurance company every month or every six months to keep your SR22 insurance active. The premium is based on the factors mentioned above, such as your driving record, age, gender, location, coverage limits, and insurance provider.

The average cost of SR22 insurance in Washington State is about $1,500 per year or $125 per month. However, this is just an estimate and your actual cost may vary significantly depending on your personal situation and the insurance company you choose.

Comparison of Rates from Different Providers

To give you an idea of how different providers charge for SR22 insurance in Washington State, we have compiled some sample quotes from some of the leading insurance companies in the state. These quotes are based on a hypothetical scenario of a 30-year-old male driver who lives in Seattle and has been convicted of DUI. He has a clean driving record except for the DUI conviction and needs to file an SR22 form for three years. He chooses the minimum liability limits of 25/50/10 and does not purchase any additional coverage. The quotes are as follows:

- Progressive: $2,016 per year or $168 per month

- GEICO: $1,872 per year or $156 per month

- State Farm: $1,728 per year or $144 per month

- Allstate: $1,584 per year or $132 per month

- USAA: $1,440 per year or $120 per month (only available for military members and their families)

These quotes are for illustrative purposes only and do not reflect the actual rates that you may receive from these or other providers.

Your rates may be higher or lower depending on your specific circumstances and the provider’s underwriting criteria.