The cost of scoliosis surgery with insurance can vary greatly based on factors like the insurance provider, plan coverage, the hospital, and the surgeon’s fees.

On average, scoliosis surgery can range from $5,000 to $10,000 out of pocket with insurance, depending on co-pays, deductibles, and coverage.

Without insurance, surgery can cost between $100,000 and $250,000, making insurance coverage essential for most families. Below, we discuss the details affecting these costs.

Factors Affecting Scoliosis Surgery Costs with Insurance

Type of Insurance Plan

Different insurance plans have different coverages. HMO plans may cover some or all of the procedure but may limit the choice of surgeons or hospitals. PPO plans offer more flexibility in choosing providers, though they may come with higher co-pays or deductibles. Knowing your plan type helps in estimating the possible costs.

Deductible Amount

The deductible is the sum of money that must be paid before insurance coverage commences. Deductibles may vary from a few hundred to several thousand dollars. Higher deductibles result in increased out-of-pocket expenses until the deductible is satisfied. Subsequently, insurance typically covers a portion or all of the remaining costs.

Co-Pay and Co-Insurance

Insurance plans often have co-pays, which are fixed amounts for services, or co-insurance, a percentage of total costs. Co-pays for major surgeries can range from $500 to $1,500 or more. Co-insurance often ranges between 10% and 30% of the total bill, depending on the specific insurance policy.

Maximum Out-of-Pocket Limits

Most insurance plans have a maximum out-of-pocket limit, capping annual spending. Once this limit is met, insurance covers 100% of any additional medical costs for the year. Out-of-pocket limits often range from $3,000 to $10,000, and meeting this limit can provide financial relief.

Pre-Authorization and Medical Necessity

Most insurance providers require pre-authorization, confirming the surgery is medically necessary. Without this, coverage may be denied, leaving you responsible for the full cost. Working with your doctor to meet these requirements is crucial.

Medical and Hospital Costs in Scoliosis Surgery

Surgical Fees

Surgeon fees can range from $10,000 to $20,000. These fees depend on the surgeon’s experience, location, and specialization in scoliosis surgery. Insurance may cover part of this, but co-insurance can leave you responsible for a portion of the surgeon’s fees.

Anesthesiologist Fees

The anesthesiologist’s fee usually ranges from $1,000 to $3,000. Insurance generally covers a part of this, but you may still have co-insurance or co-pay charges based on your plan.

Hospital Fees and Facility Charges

Hospital fees can be a large part of the cost. Charges can vary from $50,000 to $100,000. Many insurance plans cover a portion of hospital costs, but out-of-pocket expenses depend on co-insurance rates and deductible limits. Knowing if the hospital is in-network also impacts final costs.

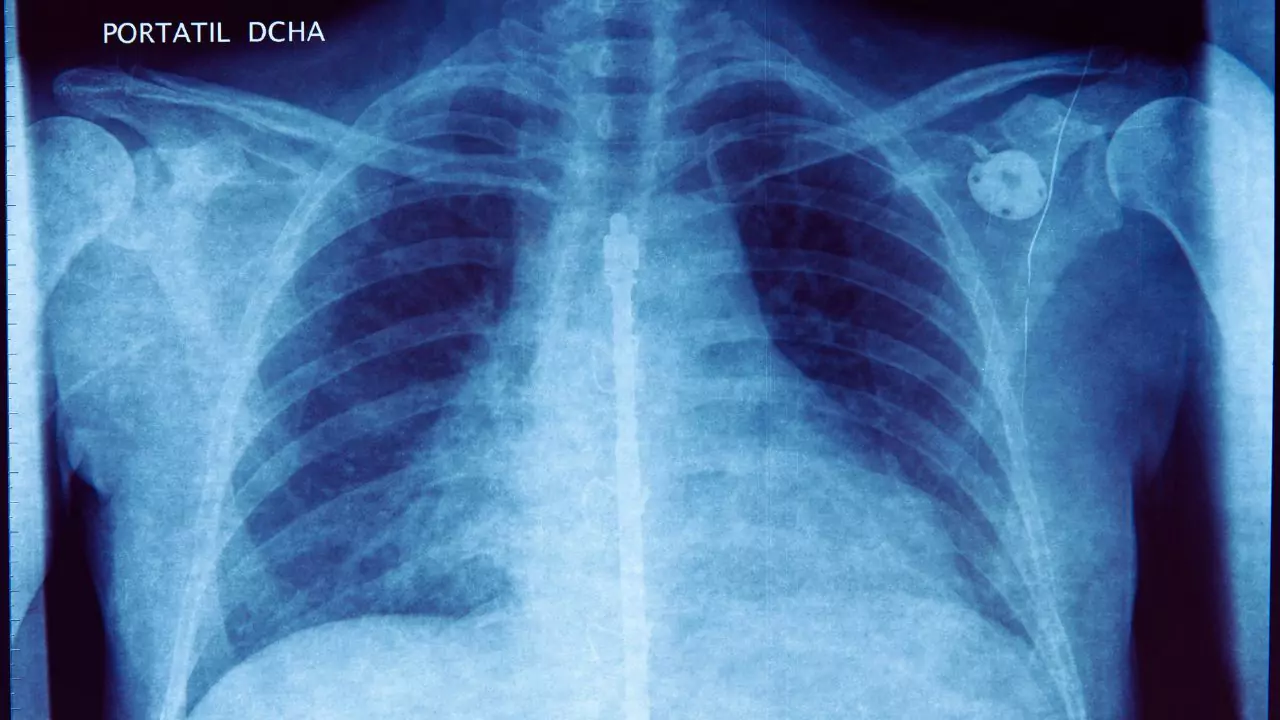

Pre-Surgery Tests and Imaging

Pre-surgery tests like X-rays, MRIs, and blood tests are necessary for planning the procedure. These can cost between $500 and $3,000. Insurance may cover these tests, but co-pays and deductibles can result in extra costs.

Post-Surgery Care and Physical Therapy

Post-surgery recovery often includes physical therapy and follow-up visits. These services can cost $100 to $300 per session, adding up to several thousand dollars. Insurance may cover some costs, but limits on sessions or co-pays can still result in expenses.

Types of Scoliosis Surgery and How They Impact Cost

Spinal Fusion Surgery

Spinal fusion surgery, the most common scoliosis treatment, involves joining spinal vertebrae with rods and screws. This procedure can cost around $100,000 without insurance. Insurance often covers a significant portion, but out-of-pocket expenses depend on your plan’s co-pay, co-insurance, and deductible.

Vertebral Body Tethering (VBT)

Vertebral Body Tethering is a newer procedure that is less invasive. It is often more expensive, ranging from $150,000 to $250,000 without insurance. Though insurance may cover some of this cost, this newer treatment may have different coverage rules. Check with your provider for coverage specifics.

Growth Rod Surgery

This surgery is for young patients whose spines are still growing. It involves adjustable rods that allow for spine growth over time. Costs are similar to spinal fusion, but additional costs may apply for follow-up adjustments. Insurance may cover this treatment but expect potential co-pays and co-insurance.

Tips to Lower Out-of-Pocket Costs

Check Network Providers

Using in-network hospitals and doctors can lower costs. Many insurance plans have a network of preferred providers, with discounts and negotiated rates. Visiting an out-of-network provider may result in higher out-of-pocket costs, so it’s best to confirm that your surgeon and hospital are in-network.

Negotiate Medical Costs

If your plan has high out-of-pocket expenses, consider negotiating with the hospital for lower rates. Many hospitals offer payment plans or discounts if you agree to a payment plan. Discussing options with the billing department can reduce expenses.

Use a Health Savings Account (HSA) or Flexible Spending Account (FSA)

HSAs and FSAs allow pre-tax dollars for medical expenses, reducing taxable income. HSAs are especially useful for high-deductible plans, helping cover out-of-pocket costs.

Ask for Generic or Lower-Cost Medications

If your recovery involves medications, ask if lower-cost options are available. Many hospitals prescribe brand-name medications that can be expensive. Generic medications can be equally effective and more affordable.

Verify Coverage Details with Your Insurance Provider

Each insurance policy has different rules. Call your insurance provider to confirm details of your plan’s coverage, co-pays, and co-insurance. This conversation will help you prepare financially for surgery.

Conclusion

The cost of scoliosis surgery with insurance can vary widely, influenced by factors like insurance type, deductible, co-insurance, and the specific hospital or doctor. On average, families can expect out-of-pocket costs between $5,000 and $10,000 with insurance. Checking your plan details, using in-network providers, and exploring options to lower costs can help manage expenses.