In this fast-paced world that we live in, our smartphones have turned into an essential component of our day-to-day lives. We utilize them in every aspect of our lives, from maintaining relationships with loved ones to operating our businesses.

However, accidents happen, and smartphones can get damaged or lost, leaving us without a crucial tool. That’s where grip insurance comes in.

In this article, we’ll explore how to get a new phone with grip insurance and what are the best companies and their Grip Insurance services.

Best Companies to Get a New Phone with Grip Insurance?

There are several companies that offer phone insurance with grip protection, which can protect your phone from accidental drops and damage. The following are some of the top companies for new phones with grip insurance:

AKKO

AKKO’s phone Only plan offers coverage for accidental damage, liquid damage, theft, and loss at reasonable pricing, starting at $6 to $12 per month or $5 to $11 a month if paid annually upfront. They also have a straightforward claims process for fast resolution.

SquareTrade

SquareTrade offers protection plans starting at $8.99 per month that cover drops, spills, and malfunctions with a 5-day service guarantee and a 30-day money-back guarantee. SquareTrade is renowned for its exceptional customer service and easy claims process.

Asurion

Asurion provides phone insurance with grip coverage at an affordable price, starting at $7.99 per month. Their plans cover drops, spills, and malfunctions, and they also offer a quick and easy claims process with reliable customer support.

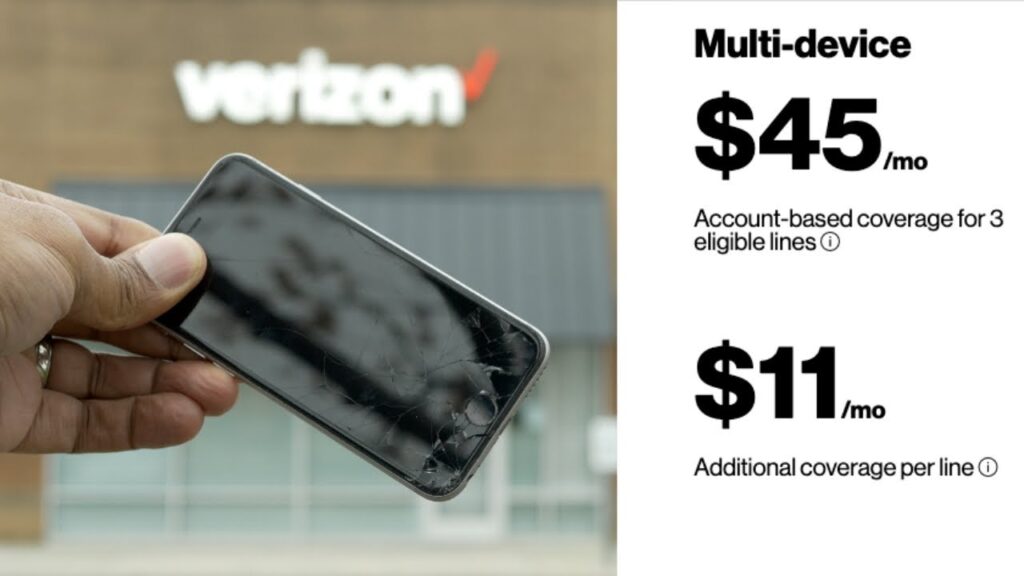

Verizon

Verizon offers Total Mobile Protection, which includes coverage for device damage, loss, and theft. Their plans start at $15 per month and include next-day device replacement and 24/7 claims service. Verizon is a trusted and reliable company with excellent customer service.

Verizon is a well-liked option among customers because of its dependable network and top-notch customer service.

My Personal Favorite – Cell Brokerage, LLC

Cell Brokerage, LLC will cover the cost of repairs, replacement, or refunds in the event that your mobile device is broken, lost, or stolen after the original manufacturer’s warranty has expired. It should be noted, however, that the policy does not pay for damage that is merely cosmetic or the result of normal wear and tear.

This warranty can only be purchased at the time of the original purchase of a handset or communication device from an authorized retailer.

The monthly charge for the warranty varies based on the type of device insured, with smartphone plans costing around $9 per month, tablets and Apple devices costing $10 per month, and everything else costing around $5 per month, as of December 2015. Renewable annual plans are also available.

In the event that you need to file a claim with Cell Brokerage, you can easily do so through their website, CellBrokerage.com. Typically, valid claims require that you pay a deductible before the company ships a replacement device to you.

It is important to keep in mind that you must return the broken device to Cell Brokerage to avoid paying a salvage fee, which could potentially cost the same as the retail value of the device in addition to the deductible.

If, after receiving a replacement device, it is discovered that it is not working properly, you can return it for another replacement within 90 days without any additional cost.

However, if Cell Brokerage determines that the malfunction was caused by your own actions, you will be responsible for paying the full value of the device.

Factors to Consider When Choosing Grip Insurance?

When choosing a phone insurance plan with grip protection, it is important to consider several factors. These factors include the cost of the plan, coverage limits, and deductibles.

It is highly recommended to carefully review the terms and conditions of your phone insurance plan to fully comprehend what is included and excluded from coverage.

When selecting a plan for phone insurance, there are several important considerations that should be given priority.

Cost

Some phone insurance plans are more expensive than others in terms of cost. It is important to consider the cost of the plan and how it fits into your budget.

Coverage Limits

Some phone insurance plans have coverage limits, which means that there may be a maximum amount of money that can be paid out in the event of a claim. Prior to purchasing a plan, it is crucial to comprehend the coverage limits of that plan.

Deductibles

Phone insurance plans may require a deductible, which is an amount of money that you will need to pay out of pocket before the insurance company will cover the rest of the cost. Prior to acquiring a plan, it is crucial to comprehend the deductible of that plan.

Terms and Conditions

To ensure a comprehensive understanding of the extent of coverage provided by your phone insurance plan, it is essential to thoroughly read and comprehend its terms and conditions. Familiarizing yourself with the claims process, as well as the timeframe for claim reimbursement, is also beneficial.

How to File a Claim?

Filing a claim for phone insurance with grip protection can seem like a daunting task, but it doesn’t have to be. Here are some general steps to follow when filing a claim:

Contact Your Insurance Provider

If your phone has been damaged, lost, or stolen, the first step is to contact your insurance provider as soon as possible. You can typically do this online or by phone, depending on your provider.

Provide Necessary Information

When filing a claim, you will need to provide your personal information, such as your name and phone number, as well as information about the incident, such as the date and time it occurred and the type of damage that was done to your phone.

Pay Any Applicable Deductibles

Depending on your plan, you may be required to pay a deductible when filing a claim. This is a set amount of money that you will need to pay out of pocket before your insurance provider will cover the remaining cost of the repair or replacement.

Follow Up with Your Provider

Once you have filed your claim, be sure to follow up with your insurance provider to ensure that your claim is being processed in a timely manner. If you have any questions or concerns, don’t hesitate to ask.

Alternatives to Grip Insurance

If grip insurance isn’t for you, there are some alternative options to consider. Firstly, some credit card companies offer purchase protection or extended warranties on electronics, including smartphones.

It’s a good idea to confirm with your credit card company whether you qualify for any available benefits. Additionally, opting for a used or refurbished phone rather than purchasing a brand-new one can result in cost savings.

Final Words

Opting for grip insurance can provide you with valuable protection against accidental damage or loss of your smartphone. With a monthly premium, you can rest assured that you won’t have to face significant expenses for repairing or replacing your phone. It is recommended to carefully assess prices, coverage options, and customer service ratings when selecting an insurance policy.

Remember to file a claim as soon as possible if your phone is damaged or lost. And finally, take steps to prevent smartphone damage in the first place. With these tips, you can get a new phone with grip insurance and keep it protected for years to come.