The coverage for repairs to your roof decking may vary depending on the cause of the damage.

Trying to repair your roof deck and unsure if insurance will cover the costs? You’re not alone. Read on to find out how you can ensure your insurance company covers the costs of roof decking repairs.

Understanding how to get insurance pay for roof decking is critical to avoiding a large financial burden. Knowing the steps that should be taken before and after filing an insurance claim will help you get the most out of your policy when it comes time to repair or replace your roof decking.

- Consult with your insurance provider to see if they offer coverage for roof decking replacement or repair. Different companies offer different levels of coverage and understanding what benefits your specific policy provides will help you prepare appropriately in advance. This includes understanding any deductibles or restrictions that may apply to roof decking claims so that you can ensure they are met in full prior to filing a claim.

- Thoroughly document existing damage before submitting a claim for roof decking. Take photographs of all current damage and keep records of all expenses associated with repairs and maintenance over the past several months, as well as any estimates received from contractors for repairs or replacements covered by insurance. Factor in all applicable taxes, permits, costs associated with debris removal, etc., as these can be included in the reimbursement amount once your claim has been approved.

- Submit the completed paperwork according to your insurance provider’s guidelines and wait for their decision on whether or not they will cover the replacement of decking due to damage sustained over time by general wear and tear, storms, or other weather conditions or other causes listed in the policy language.

- Keep detailed records throughout this process – including contact information for representatives handling your case – so that you can troubleshoot any issues with payment as necessary should they arise.

Following these steps will help maximize chances of getting full coverage from insurers when it comes time to replace damaged roof decking due to normal wear-and-tear and/or natural disasters like wind, hail, and rain pounding against it over time!

Key Takeaways

- If your roof is damaged due to an act of nature or an unexpected accident, your homeowner’s insurance will likely pay to have it repaired or replaced.

- Insurance companies often won’t help pay to fix or replace a roof that has been degrading slowly over time due to things like weather or lack of maintenance.

- Coverage is typically inadequate, if present at all, for roofs older than 20 years.

- Having documentation of repairs, including before and after pictures and inspection reports, increases the likelihood that your claim will be accepted. When something breaks, you need to contact your insurance carrier right away.

Understanding Your Insurance Policy

When considering if your home insurance policy will pay for roof decking, it’s important to understand the types of coverage it offers and any exclusions and limitations associated with them. To determine what coverage is available, take a look at the details of your policy and identify any exclusions or limitations that could affect the repayment. You’ll need to be aware of what your insurance company covers and any possible exclusions or capping of expenses when it comes to paying for roof decking.

The common types of coverage provided by most home insurance policies include:

- Fire damage

- Water damage

- Vandalism

- Theft

- Storm damage

When evaluating roof decking costs for these types of scenarios make sure you factor in additional costs like labor or replacement materials such as nails, shingles, and soffit boards. Insurance companies may have set limits on reimbursements for these costs or may not cover them at all.

Insurance policies can also have general exclusions which could include animal damage or rust that prevent the insurer from paying out certain claims. It’s important to read through your policy in order to be aware of potential gaps in protection that could leave you vulnerable in case something goes wrong – which is why it’s so essential to know exactly what type of coverage your policy provides before you decide whether it will pay for roof decking or not.

Finally, when making claims due to storm-related incidents you’ll want to consider any rules around deductibles that your insurer may impose before they issue benefits payments – this will require you to pay a premium portion prior to being able to file a claim.

Making sure you fully understand all terms associated with your home insurance policy is critical when seeking reimbursement for roof decking repairs or replacements so check its provisions carefully before making a decision about coverage and the claims filing process as an unexpected bill is not something anyone wants!

What is Roof Decking?

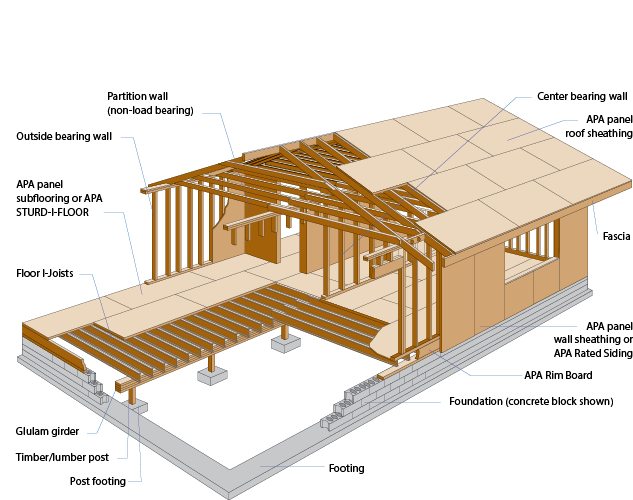

When considering roof decking and repairs, it is important to know what roof decking is and how it can be beneficial. Roof decking, also known as roof sheathing or plywood, is a layer of material that serves as a protective barrier and often forms the foundation of the roof as a whole. It is important to understand the features and purpose of roof decking before attempting any repairs.

Roof decking provides an essential layer of protection between the exterior elements and your home’s interior. If damaged or improperly installed, moisture intrusion can increase the amount of heat loss in your home while lowering its energy efficiency. Other problems associated with improper roof decking installation include:

- Accelerated deterioration resulting from water damage.

- Severe structural weaknesses due to rotting wood or buckling boards.

- Gaps between boards leave room for pests such as mice to penetrate your attic space causing further damage to the insulation or other wiring issues.

Knowing what type of roof decking is best for your home based on its location, climate, and age will help ensure your safety and security when considering repair costs associated with insurance coverage. Having the proper types of protection in place with adequate maintenance can prevent long-term repair costs from weather damage or other causes, making it easier for insurance companies to pay for any needed repair work without worrying about pesky deductibles. Roof decks are an integral part of protecting your home – make sure that yours gets adequately taken care of every year!

Is Roof Decking Covered By Insurance?

When considering roof decking insurance coverage, it’s important to know exactly what type of repairs or replacements may be covered. Different homeowners insurance policies have different limitations and conditions, and coverage will depend largely on the type of damage that has occurred and the age of the roof. Generally speaking, most homes with newer roofs should have some form of coverage for damages and repairs that are beyond normal wear-and-tear, such as a major storm.

Insurance companies usually require an inspection of your home before offering any coverage for roof decking. This is to help ensure that any changes you make won’t impact your home’s structure in any way. The inspector will also be checking to see if existing features need replacing or repairing, such as deteriorated wood flashing or missing screws. If any of these items need attention, it’s best to get them repaired or replaced before submitting an insurance claim and having the work done yourself.

It’s also important to note that there may be additional expenses involved with installing new roof decking – such as supplies like nails, screws, and clips – which insurance companies typically don’t cover in their policies. Be sure to check any policy documents carefully for details about what may or may not be covered when it comes time for roof decking installations.

How Roof Coverage Works?

When it comes to roof decking, it’s important to understand how insurance coverage works. Many homeowners are unaware that their homeowner’s insurance may cover the cost of replacing or repairing a roof deck, depending on the extent of the damage. It is important to understand your homeowner’s policy and any set limits for roof coverage before installing a new or replacement roof deck.

Generally, an insurance company will not cover costs for damage caused by weather such as wind and hail but may cover costs for fire or water damage caused by broken pipes or plumbing. Make sure to read your policy carefully and ask questions if necessary before attempting a repair or replacement of your existing decking.

Also, note structural issues with your existing decking will not be covered by insurance; this generally falls under home maintenance which includes inspections and replacements should they become necessary. If you are unsure whether an issue could potentially be covered by insurance, it is best to consult a professional – preferably one who is licensed in both construction and property insurance – prior to submitting a claim.

Homeowners must also provide detailed photos of any potential damages prior to submitting an insurance claim, as companies are unlikely to pay out if they can not assess the full extent of any potential losses that have been suffered during installation or repairs.

Special Considerations for Roof Coverage

When getting insurance to pay for roof decking, it’s important to understand the special considerations that will come along with your coverage. Your policy should outline specific requirements that must be met in order for the coverage to be valid. For instance, many policies require that boards and beams used in a deck must meet certain fire safety standards set by the National Fire Protection Association (NFPA). Additionally, your policy may specify the type of material and placement of nails, screws, or fasteners when constructing a deck. Be sure to consult these details before beginning any work on an outdoor deck.

It’s also important to consider obtaining additional coverage in case of damage from storms or other random events such as downed trees or animals gnawing on boards. Depending on where you live, flood insurance may also be necessary if the building is close to any water source.

If there is any doubt about what materials are covered under your policy and if additional coverage should be obtained for extra protection, contact your insurance provider for clarification and advice. Then, once all conditions are taken into account, you can proceed with peace of mind knowing that you have taken all necessary steps to protect yourself and the structure of your roof decking project.

Preventing Roof Problems

Homeowners should be proactively taking steps to prevent roof problems from happening in the first place, as this can help save money in the long run and could mean insurance will pay for decking repairs. Roofs are vulnerable to damage both from extreme weather conditions, as well as animals, debris, and overall wear and tear due to age. Implementing preventive measures is one way to ensure that you protect your investment in your home’s roof.

The first step is making sure the right materials are used on your home’s roof, whether it’s replacing existing materials or installing new ones. Ensure you opt for higher-quality materials that are appropriate for the climate you live in – talk to a local contractor familiar with regional regulations if you’re unsure which type of material is best suited for your region’s environments. High-quality materials also tend to last longer than lower-cost alternatives.

Next, inspect and repair any existing damage or areas of concern on a regular basis. Make sure there aren’t any weak spots or broken pieces of decking and shingles that can affect the integrity of the roof, as well as trim exposed edges regularly to ensure nothing hangs over the edge of the roof line that could put additional strain on it and compromise its stability. Finally, use an ice guard sloped towards at least a ¼ inch angle when temperatures drop below freezing on roofs where ice accumulates so water has an easier exit than entrance points when melting.

Doing all these tasks proactively will help prevent more serious problems down the line – many of which may not be eligible for reimbursement under the homeowner’s insurance policy if neglected beforehand – potentially saving homeowners thousands of dollars in repairs or full replacement costs if needed.

Getting Reimbursed for Roof Replacement

Replacing your roofing is an expensive and time-consuming job, but it’s essential to any well-maintained building. Depending on the age of your roof and its condition, you may be wondering how to get insurance to pay for new roof decking. Fortunately, some insurance policies cover repairs to your roof in the event of damage due to an unforeseen disaster.

In general, insurance companies require that certain criteria are fulfilled before they will offer reimbursement for roof replacement. First and foremost, roofs must meet certain safety standards in order to be approved by the insurer. Second, when a claim is made for damage on the roof or other parts of a building, it must have occurred due to reasons beyond your control – such as extreme weather conditions affecting your property or a nearby area. Your insurer’s coverage documents should go into further detail about what is eligible for reimbursement under their policy terms.

Additionally, any repairs you carry out as part of installing new roof decking will need to meet industry standards set by governing authorities in order for you to claim back expenses. Documents proving adherence to these standards must be provided when requesting reimbursement from an insurer after completing a repair job on your property’s roofing system.

By understanding what requirements you need when applying for insurance payment towards replacement decking materials or repair work on an existing structure, the process can go smoother than if you attempt it blind. Make sure to conduct thorough research prior to attempting any major works related to roof replacement so that you can optimize your chances of getting reimbursed from an insurer afterward!

When Should You Consider Building Codes Coverage?

When considering roof decking, it is important to properly insure your project and make sure that you are properly covered in the event of any damage or unexpected expenses. Many insurance companies offer building codes coverage, a valuable policy that can help protect your home if it is ever damaged due to a conflict with city regulations. This type of coverage ensures that you won’t be responsible for any expenses related to a violation of local building codes, so it’s important to look into any roof decking project.

Building code coverage is typically only applicable when the code in question was not in effect at the time of construction or when compliance with these codes becomes mandatory after the existing structure deviates from them. Most insurance providers will take into account factors such as size, location, and materials used when assessing the risk level associated with an individual structure and then calculating how much coverage is required to adequately protect against potential damages or extra expenses should an issue arise.

Ultimately, it’s crucial for anyone interested in installing new roof decking to speak with their homeowners’ insurance provider about what type of protection they currently have – or need – against potential conflicts with local building codes. Doing so could save you thousands if there are code changes along the way – something fairly common given local regulations often shift over time – and give you peace of mind during the process.

Conclusion

The process of getting insurance to pay for roof decking can be a bit tricky. To start, it is important to understand what kind of damage you have on your roof and how much it will cost to repair and replace it. Once the damage has been determined, taking photos, gathering estimates, and filing a claim are all key steps in the process. Additionally, finding a reputable contractor offering competitive pricing is essential in order to get the best deal on replacement decking.

By thoroughly researching all of your options prior to getting started with repairs or replacement work, you can ensure that you get the most out of your insurance coverage without having to break the bank. Following these steps will help get your project moving in the right direction and ensure that you get everything done properly in order to help prevent future issues from arising:

- Research all of your options

- Find a reputable contractor with competitive pricing

- Take photos and gather estimates

- File a claim

With these precautions taken care of, you can be sure that your investment in new roof decking will last for many years to come!