Egg freezing is a procedure that allows women to preserve their fertility by storing their eggs for future use.

However, egg freezing can be expensive and not always covered by insurance.

In this article, we will explain what egg freezing is, why it is important, and how insurance coverage for egg freezing works.

We will also explore some alternative payment methods for egg freezing that may help reduce the financial burden.

Understanding Egg Freezing and Insurance Coverage

What is egg freezing and why is it important?

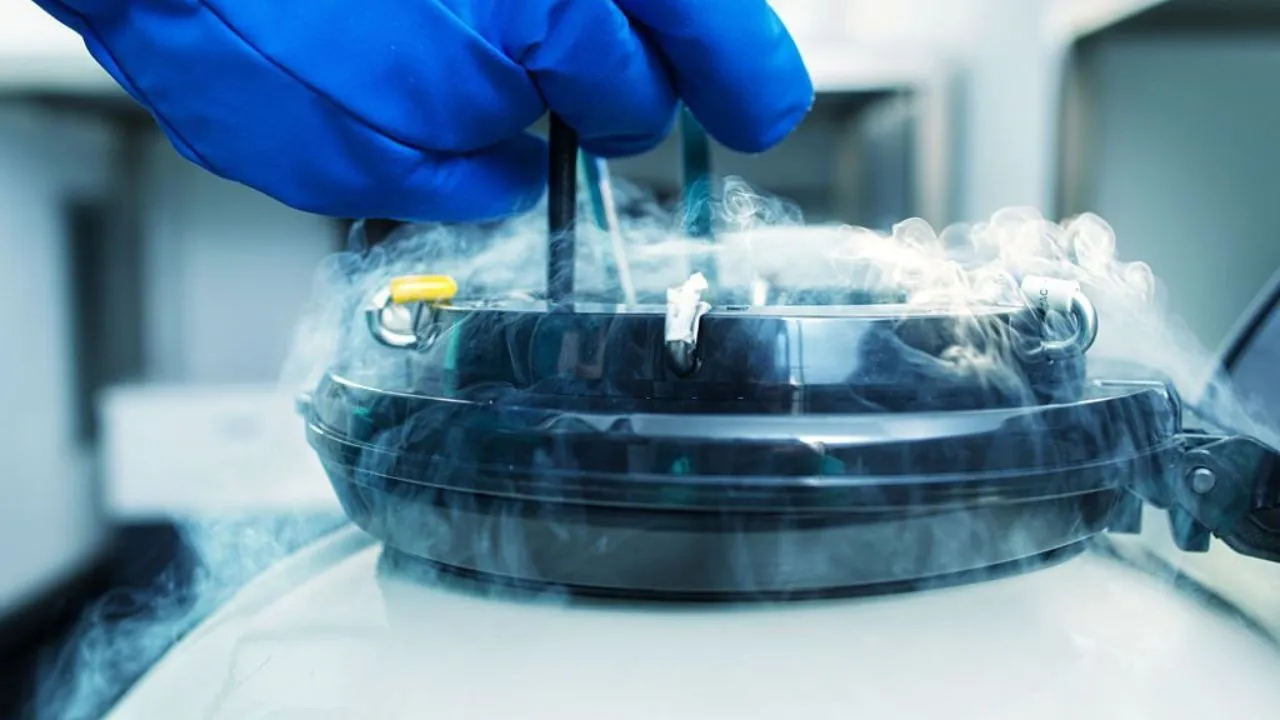

Egg freezing involves women taking hormones to stimulate the production of multiple eggs. These eggs are then extracted from the ovaries and preserved in a laboratory through freezing. They are stored until the women decide to utilize them for future pregnancy purposes.

Egg freezing can help women who want to delay motherhood for various reasons, such as career, education, travel, or finding the right partner.

Egg freezing can also help women who face medical conditions that may affect their fertility, such as cancer, endometriosis, or premature ovarian failure.

Egg freezing is important because it can give women more control over their reproductive choices and increase their chances of having a biological child in the future.

Women are born with a limited number of eggs that decline in quantity and quality as they age. The older a woman gets, the fewer eggs and chances she has to conceive naturally.

Egg freezing can help preserve the quality of the eggs and extend the window of opportunity for conception.

Factors That Determine Insurance Coverage For Egg Freezing

Insurance coverage for egg freezing depends on several factors, such as:

- The state where you live: There are 16 states that require insurance companies to cover some of the costs associated with fertility treatments, egg freezing being one of them. These states are Arkansas, California, Connecticut, Delaware, Hawaii, Illinois, Louisiana, Maryland, Massachusetts, Montana, New Jersey, New York, Ohio, Rhode Island, Texas, and West Virginia.

- The type of insurance plan you have: Some insurance plans may cover egg freezing partially or fully if it is done for medical reasons, such as cancer treatment or genetic disorders. However, most insurance plans do not cover egg freezing for elective or social reasons, such as delaying motherhood.

- The employer you work for: Some employers may offer to cover the cost of egg freezing as a benefit or perk to attract and retain female employees. For example, some tech companies, such as Apple, Facebook, and Google, offer coverage for egg freezing to their employees.

- The requirements for insurance coverage: Even if your insurance plan or employer covers egg freezing, you may need to meet certain criteria or conditions to qualify for coverage. For example, you may need to have a diagnosis of infertility, a referral from a doctor, prior authorization from the insurance company, or a limit on the number of cycles or eggs covered.

Costs Of Egg Freezing For Those Without Insurance Coverage

The cost of egg freezing can vary depending on the clinic, the location, the number of cycles, and the medications involved.

However, according to FertilityIQ, the average cost of egg freezing can range between $15,000 and $20,000 per cycle.

On average, it takes about 2.1 cycles to get enough eggs. This cost does not include medications, which can cost another $5,000, or storage fees, which cost about $500 per year.

Additionally, when women are ready to use their frozen eggs, they will need to pay for thawing and insemination costs, which can be another $7,500.

Insurance Coverage for Egg Freezing

Types of insurance plans that cover egg freezing

There are different types of insurance plans that may cover egg freezing, such as:

- Health Maintenance Organization (HMO) plans: These are plans that require you to use a network of doctors and facilities that have contracts with the insurance company. HMO plans may cover some or all of the costs of egg freezing if it is medically necessary and approved by the insurance company.

- Preferred Provider Organization (PPO) plans: These are plans that allow you to use any doctor or facility you want, but you may pay more if they are out of network. PPO plans may cover some or all of the costs of egg freezing if it is medically necessary and approved by the insurance company. However, you may have higher deductibles, co-payments, or coinsurance than HMO plans.

- Point of Service (POS) plans: These are plans that combine features of HMO and PPO plans. POS plans may cover some or all of the costs of egg freezing if it is medically necessary and approved by the insurance company. However, you may need to get a referral from your primary care provider and use a network of doctors and facilities.

- High-Deductible Health Plan (HDHP) with Health Savings Account (HSA): These are plans that have lower premiums but higher deductibles than other plans. HDHPs may cover some or all of the costs of egg freezing if it is medically necessary and approved by the insurance company. However, you may need to pay a large amount of money out of pocket before the insurance kicks in. HSA is a tax-advantaged account that you can use to save money for medical expenses, including egg freezing.

Coverage Levels For Different Insurance Providers

The level of coverage for egg freezing may vary depending on the insurance provider and the plan you have. Here are some examples of how different insurance providers may cover egg freezing:

- Aetna: Aetna may cover egg freezing for medical reasons, such as cancer treatment, genetic disorders, or premature ovarian failure. However, Aetna does not cover egg freezing for elective or social reasons, such as delaying motherhood.

- Blue Cross Blue Shield: Blue Cross Blue Shield may cover egg freezing for medical reasons, such as cancer treatment, genetic disorders, or premature ovarian failure. However, Blue Cross Blue Shield does not cover egg freezing for elective or social reasons, such as delaying motherhood. The level of coverage may depend on the state where you live and the plan you have.

- Cigna: Cigna may cover egg freezing for medical reasons, such as cancer treatment, genetic disorders, or premature ovarian failure. However, Cigna does not cover egg freezing for elective or social reasons, such as delaying motherhood. The level of coverage may depend on the state where you live and the plan you have.

- UnitedHealthcare: UnitedHealthcare may cover egg freezing for medical reasons, such as cancer treatment, genetic disorders, or premature ovarian failure. However, UnitedHealthcare does not cover egg freezing for elective or social reasons, such as delaying motherhood. The level of coverage may depend on the state where you live and the plan you have.

Requirements for Insurance Coverage

To qualify for insurance coverage for egg freezing, you may need to meet certain requirements or conditions, such as:

- Having a diagnosis of infertility: Infertility is defined as the inability to conceive after 12 months of unprotected sex for women under 35, or after six months of unprotected sex for women over 35. Some insurance plans may require you to have a diagnosis of infertility from a doctor before they cover egg freezing.

- Having a referral from a doctor: Some insurance plans may require you to have a referral from your primary care provider or a specialist before they cover egg freezing. The referral may need to include the reason for egg freezing, the expected outcome, and the estimated cost.

- Having prior authorization from the insurance company: Some insurance plans may require you to have prior authorization from the insurance company before they cover egg freezing. The prior authorization may involve submitting a request form, providing medical records, and getting approval from the insurance company.

- Having a limit on the number of cycles or eggs covered: Some insurance plans may have a limit on the number of cycles or eggs they will cover for egg freezing. For example, some plans may cover only one cycle or up to 10 eggs per cycle. If you need more cycles or eggs, you may have to pay out of pocket for the extra costs.

Benefits Of Utilizing Insurance Coverage For Egg Freezing

Utilizing insurance coverage for egg freezing can have several benefits, such as:

- Reducing the financial burden: Insurance coverage can help reduce the financial burden of egg freezing by covering some or all of the costs involved. This can make egg freezing more affordable and accessible for women who want to preserve their fertility.

- Increasing the success rate: Insurance coverage can help increase the success rate of egg freezing by allowing women to freeze more eggs or do more cycles. This can increase the chances of having a viable egg that can be fertilized and result in a live birth in the future.

- Enhancing the quality of life: Insurance coverage can help enhance the quality of life of women who want to freeze their eggs by reducing their stress, anxiety, and guilt. This can help them feel more confident, empowered, and optimistic about their reproductive choices and future family.

Alternative Payment Methods for Egg Freezing

Financing Options and Payment Plans

Some clinics offer financing options and payment plans for egg freezing that can help you spread the cost over time. For example, some clinics partner with companies that provide loans for fertility treatments, such as Lending Club and CapExMD.

These loans may have flexible monthly payment options, low-interest rates, and fast approval processes. However, you may need to have a good credit score, a stable income, and a co-signer to qualify for these loans.

Another financing option is to use a credit card to pay for egg freezing. This can help you earn rewards, avoid interest charges if you pay off your balance quickly, and use your card at any clinic you want.

However, credit cards may have high-interest rates, fees, and penalties if you miss a payment or carry a balance. You may also need to have a high credit limit to cover the full cost of egg freezing.

Employer-sponsored Benefits or Programs

Some employers may offer benefits or programs that can help you pay for egg freezing. For example, some employers may provide insurance coverage, reimbursements, discounts, or subsidies for egg freezing as part of their health or wellness benefits.

Some employers may also offer flexible spending accounts (FSAs) or health savings accounts (HSAs) that allow you to use pre-tax dollars to pay for medical expenses, including egg freezing.

However, you may need to check with your employer about the eligibility criteria, the amount of coverage or contribution, and the expiration date of these benefits or programs.

Grants and Scholarships for Fertility Treatments

Some foundations, organizations, and even some state governments offer grants and scholarships for fertility treatments, including egg freezing.

For example, some foundations like the Angels of Hope Foundation and Baby Quest Foundation offer grants to cover part of the cost of egg freezing for women who have medical conditions that affect their fertility.

Some state governments like New York and Connecticut offer grants to cover part of the cost of egg freezing for women who are undergoing cancer treatment or have a high risk of cancer. However, you may need to meet certain eligibility criteria, submit an application, and compete with other applicants to receive these grants and scholarships.

Pros and cons of alternative payment methods

Alternative payment methods for egg freezing can have some pros and cons, such as:

- Pros: Alternative payment methods can help you reduce the upfront cost of egg freezing, make it more affordable and accessible, and give you more options and flexibility to choose the clinic and the timing of your procedure.

- Cons: Alternative payment methods can also add to your debt, increase your interest charges, lower your credit score, limit your choices, or require you to meet certain conditions or deadlines.