The person in charge of settling insurance premiums is known as the subscriber. This individual is designated as the chief policyholder, with their name and contact details appearing on the insurance card.

In order to determine the subscriber on an insurance card, seek out the ensuing details:

- The subscriber’s name could be labelled as “Subscriber“, “Member“, or “Patient“.

- The subscriber’s identification or policy number might bear tags such as “Policy #”, “Policy ID”, “Member ID”, or “ID #”.

- The group number or plan number is likely marked as “Group #”, “Group ID”, or “Plan #”. This code is associated with your employer’s insurance scheme, assuming your coverage is job-related.

Do insurance cards provide specific information about the insurance subscriber?

Yes, insurance cards provide specific information about the insurance subscriber, such as their name, subscriber ID, group number, and type of insurance plan.

This information helps the insurance company and the healthcare providers identify the subscriber and their benefits.

Here are some of the specific information that may be found on an insurance card:

- Subscriber’s name

- Subscriber’s date of birth

- Subscriber’s gender

- Subscriber’s contact information

- Subscriber’s ID number

- Subscriber’s group number

- Subscriber’s plan type

How can you differentiate between the insurance subscriber and dependents on an insurance card?

There are a few ways to differentiate between the insurance subscriber and dependents on an insurance card.

- Look for the subscriber’s name: The subscriber’s name will be listed first on the insurance card.

- Look for the dependents’ names: The dependents’ names will be listed below the subscriber’s name.

- Look for the subscriber’s ID number: The subscriber’s ID number will be listed on the insurance card, but it may be in a different format than the dependents’ ID numbers.

- Look for the dependents’ relationship to the subscriber: The dependents’ relationship to the subscriber may be listed on the insurance card.

What steps can you take to verify the insurance subscriber’s identity using an insurance card?

Here are some steps you can take to verify the insurance subscriber’s identity using an insurance card:

- Check the name and contact information on the insurance card: The name and contact information on the insurance card should match the information that the subscriber provides to you.

- Check the ID number on the insurance card: The ID number on the insurance card should match the information that the subscriber provides to you.

- Check the expiration date on the insurance card. The insurance card should not be expired.

- Ask the subscriber to provide additional information: You may ask the subscriber to provide additional information, such as their date of birth, Social Security number, or driver’s license number.

- Call the insurance company: If you are still not sure if the subscriber is who they say they are, you can call the insurance company to verify their identity.

It is important to note that the steps you take to verify the insurance subscriber’s identity may vary depending on the insurance company.

How do insurance companies authenticate the identity of the insurance subscriber based on their insurance card?

Insurance companies verify the insurance subscriber’s identity using their insurance card, comparing the information provided on the card with the details submitted by the subscriber during a claim or communication with the company.

This information typically comprises the subscriber’s name, date of birth, gender, and contact details. Additional data, like the subscriber’s ID number, group number, and plan type, may also be included.

To authenticate the insurance subscriber’s identity, insurance companies may employ various methods, including:

- Comparing the subscriber’s signature on the insurance card with the signature on file.

- Requesting a photo ID from the subscriber.

- Asking the subscriber to answer security questions.

- Contacting the subscriber via phone to confirm their identity.

The specific authentication methods utilized by an insurance company can differ depending on the company itself.

Do insurance cards have unique identifiers for each insurance subscriber?

Yes, most insurance cards have unique identifiers for each insurance subscriber. This identifier is usually a number, but it may also be a letter or a combination of letters and numbers. The identifier is used to identify the subscriber when they file a claim or contact their insurance company.

The unique identifier is usually assigned to the subscriber when they first sign up for insurance. The identifier is then printed on the insurance card. The identifier may also be stored in the insurance company’s computer system.

The unique identifier helps to prevent fraud and identity theft. It also helps the insurance company to track claims and payments.

Can the insurance subscriber’s coverage details be found on their insurance card?

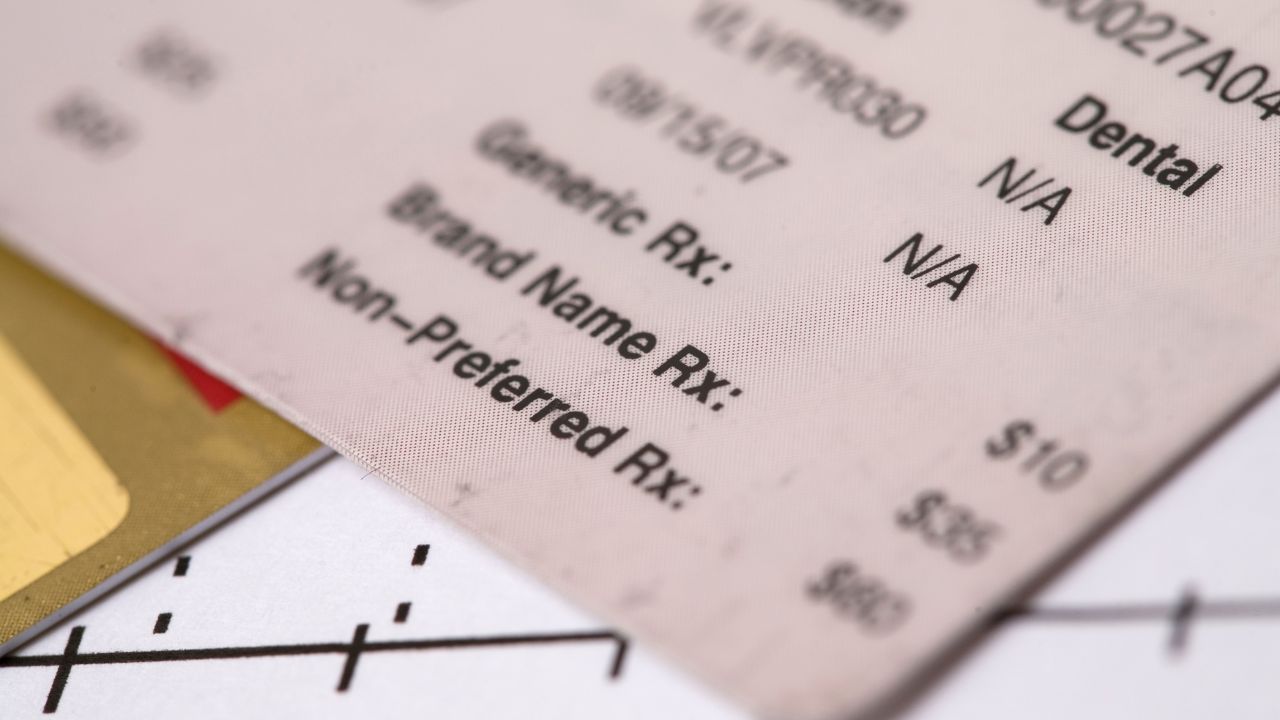

Yes, the insurance subscriber’s coverage details can be found on their insurance card.

The contents of the card vary based on the insurance company’s specifications, but usually comprise the following components:

- Plan type: Plan type represents the kind of insurance plan the subscriber possesses.

- Coverage limits: Coverage limits define the highest sum the insurance company commits to pay for approved medical costs.

- Deductible: Deductible refers to the amount the subscriber must bear before the insurance company initiates payment for approved medical costs.

- Copayment: Copayment constitutes a set sum the subscriber is responsible for per approved medical service.

- Coinsurance: Coinsurance expresses a portion of the cost of an approved medical service the subscriber is obligated to pay.

- Out-of-pocket maximum: Out-of-pocket maximum marks the highest sum the subscriber will spend on approved medical costs within a year.

- Prescription drug coverage: Prescription drug coverage denotes the coverage provided by the insurance company for prescription medications.

- Mental health coverage: Mental health coverage signifies the coverage offered by the insurance company for mental health services.

- Dental coverage: Dental coverage indicates the coverage provided by the insurance company for dental services.

Vision coverage: Lastly, vision coverage implies the coverage offered by the insurance company for vision services.